Partnership Agreement: All you Need to Know About

What is Partnership Agreement?

The Partnership Agreement is a legal document formed between all the owners or partners of the company. It consists of all the mandatory pointers jotted down to tackle future clashes, disagreements, and unfair practices. The agreement shall be known by the name ‘Operating Agreement’ if the company is limited liability. Moreover, if the partnership is meant for a corporation, it is recalled by the word ‘Shareholder Agreement.’ We call it by the name ‘Business partnership agreements’ for the partners or parties who are forming only a general partnership agreement. This legally written document oversees the following things:

1. Amendment of this Agreement.

2. It oversees the relationship between the partners to occur as the partners themselves. Also, it manages the relationship among the partners and their partnership.

3. The partnership is meant for what business and how that business is administere.

Such Agreements help to state everything written as proof. It further helps to fairly resolve all the disputes that shall take place between the partners of the Agreements. The most important thing to remember is to form Partnership Agreements as soon as the company gets formed. The overall purpose of this letter is to safeguard each partner’s investment into starting the business. In addition, to this, it also defines all the rights & responsibilities, terms, conditions, rules, restrictions, etc., for each part of the agreement.

What is Includes in a Partnership Agreement?

The Partnership contract is a written deal that takes place between at least two individuals. The partners of this deal come forward willingly with the perspective of conducting and managing the business together with the overall motive to gain huge profits. All the parties are equally liable to bear the losses, debts, and even profits in a partnership. Although, the sharing percentage is alterable based on mutual understanding and the type of deal you have set.

The primary benefit you get in such agreements is that the overall income generated has only one-time tax. Once you sign this agreement, you become responsible for performing all of your underlined roles and duties. The deal allows you to get back and check the terms, conditions, conflict management, profits & losses to be borne by each partner, your expected contributions, etc. It includes a lot of basic things for the clarity of all the partners. As per Investopedia, the document generally encompasses the following details:

1. Sharing of Profits, Losses, and Draws

Each partner’s profits, losses, and business draws need to be clearly stated and defined in the agreement letter. Generally, this decision among the partners is finalize considering each partner’s business ownership percentage. Therefore, despite the ownership stake, the business’s profits, losses, breakeven are shared equally among all the partners.

2. Stating Full Partnership Name

You might have heard the fact that ‘common sense is not too common!’ Yes, it might sound like a big-time common thing for each partner to mention its full name over the partnership agreement; many don’t do it. Instead, they think of doing it later, and the latter never arrives, which creates problems in the future. But, along with all of your partners, you need to decide the name by which others recognize your business.

3. Partner’s Sudden Death or Withdrawal from the Partnership

Nobody is sure about their life, and anybody at any point in time can witness the death or might get some emergency due to which he needs to withdraw from the agreement. Therefore, the business should make all the possible alternatives if such natural calamities occur as the company shall overcome such scenarios. For example, whether to adopt the life insurance policy, who shall replace the person leaving due to sudden emergency – all such things need to be decided and mentioned in the agreement beforehand.

4. Individual Partner Contribution & Ownership

In this section, you clearly define distinctive contributions the partners will bring to the business. In contrast to this, the decision regarding the ownership percentage needs to be declared here itself.

5. Power of Individual Partner

Partnership authority, also known as binding power, should be defined within the partnership agreement. It needs to consist of the section concerning the partner or partners that hold binding authority. If it’s not mentioned, it can provide the pathway to the company to unseen future risks.

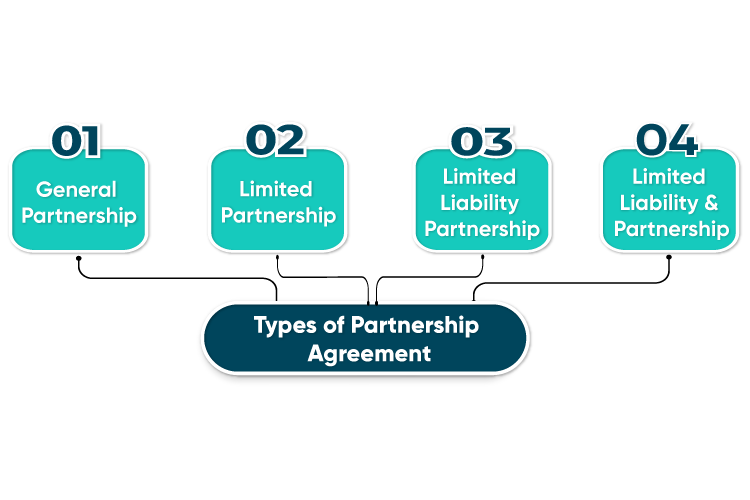

What are the Four Types of partnership?

Four types of partnerships are mention below:

1. General Partnership

General Partnerships are considerably generic types of partnerships. In such partnerships, the business partners establish their company by simply signing the Partnership Agreement without many other formalities. Such partnerships have the comfort of establishing and dissolving with ease.

In a specific case, if any partner of the signed deal encounters death or goes bankrupt, the partnership will dissolve automatically. Each partner might be at a particular term in the agreement. Despite this notion, each of the partners is provided with the possession and earnings evenly.

2. Limited Partnership

The state generally approves of LPs – Limited partnerships. These kinds of partnerships are formally establish business entities. The Limited partnership agreement work uniquely. It has at least one general partner, and other partners are supporters. The general partner takes care and accountability of the business from handling to managing the smallest to most considerable business aspects.

Although supporters or limited partners provide money to the business, they aren’t actively looking after the business operations and management. Limited owners’ only role is to invest their money in the industry and earn good returns later. They are far away from any business debts or liabilities.

3. Limited Liability Partnership Agreement

The Limited Liability Partnership agreement overall partnership structure works in the same manner as the general partnership. The Limited Liability Partnership is permite in the limited states. It is meant only for accountants, lawyers, and doctors. All the partners of the business share expected and equal benefits and responsibilities as well. Also, In such a partnership, one partner’s actions don’t affect the other partners.

For example, if one takes out a loan and cannot repay it on time, other partners are not responsible for refunding that loan amount. Henceforth, talking about all the debts and liabilities – although all partners are responsible for it, the errors or mistakes committed by one partner aren’t passed on to other partners.

4. Limited Liability Limited Partnership

The concept of the limited liability limited partnership is unique and has recently come into the picture. It’s applicable, implemented, practiced, and accepted only in a few states. The limited liability limited partnership operates similarly to the limited partnership.

Here, you will find at least one general manager who is taking care of the entire business. Although, in the limited liability limited partnership, the liability factor of the general partner is determinate. It ensures that all the partners are safeguard from unwanted liabilities. It is authorized in Nevada, Washington, Texas, Florida, Arizona, etc.

Checkout Business Partnership Agreement Format

How to Use this Document?

The written record of any partnership has the tremendous privileges to fight against any odd situations. If you are one of the partners of this document, then you can use it to save yourself in the following ways:

1. To State Which Partner Possesses the Company.

A partnership agreement provides adequate constraints over the sales and dividends flow in a company. It helps to monitor who inhabits the entire business of the company. If you are not clearly stating how the selling of interests occurs in the written legal letter, then the industry owner holds the right to sell it to anybody of his choice, even their competitor.

Moreover, all the business partners shall also specify the following steps when the business owner meets a disability issue or a sudden death. If they aren’t doing so, then there are chances that by default, the deceased person’s family members can take his place, and they could become your business partners ahead.

Illustrating such provisions in advance helps to overcome any natural calamities which aren’t in our hands. Moreover, other partners can also reserve their stake percentage in the company and restrict the sudden unplanned entry of new partners.

2. To Take off the Partner Who isn’t Able to Perform.

Multiple partners come together, join hands together to establish a business promising initially to put the best of their efforts. But, often, you may find that the initial promises are hardly kept and are often neglect later.

Such cases might happen when you come into a partnership with one of your family members or a close loved one. They might start acting in ways that could prove harmful for the business. Another threat facing the partner is that he might discontinue the industry or join another company, your competitor.

It is expected if your business sinks and isn’t going as per the forecasted growth or not getting enough heavy returns on investment. In such a case, the other partners want to eliminate such a fellow partner who is just occupying a seat to get a share without making any solid contribution to the business.

Wine unique Claus in the agreement, a good pattern should decide to eliminate such problem creating or non-performing partners.

3. To Safeguard the Minority Holders.

A partnership agreement shall comprise all the provisions for safeguarding the minority partners in the business. One of the provisions named ‘Tag Along,’ in the scenario of a buy-out, secures the minority owners.

Minority owner holds the authority to refuse to work with an undesirable and newly appointed co-owner of the business. Imagine a situation where the majority owner ends up selling all of his interests to a third-party holder.

In this case, the minority partner holds all the liberty to sell her interests based on the common grounds, subsequently participating in the transaction this way. The primary aim of the provision is to make sure that the exact buy-out offers are being escalate to every partner, whether major or minor.

It lets the minority owners say no to an offer that isn’t much profit to him.

4. To mutually get the preset consent for agreeing beforehand to the unseen emergency.

A well-written Partnership Contract provides the legal push to all the fellow partners for agreeing beforehand over the crucial judgments. The best example of such a situation is partner opinion clash resolution. and every kind of agreement has a mandatory provision talking about the ways for conflict handling and resolving.

In addition, every partner includes the dispute resolution provision in the partnership agreement, where the need for mediation accompanied by binding arbitration shall be there. Suppose you haven’t taken all of this into a written letter.

In that case, there aren’t any means left to solve the dispute without getting into legal formalities that indeed prove to be expensive and time-consuming.

5. To Safeguard Yourself From the State’s Laws.

A well-written agreement allows you to refuse to follow the rules set by the state by default, and such agreements taken in writing will enable you to make modifications as per the demand of the situation.

If you don’t have anything such as a ‘partnership contract, ‘you are stuck in a place where you need to follow that state’s laws and orders to resolve your issues. It might lead to the weakening power of the business owner as he won’t be allow to take or drive business decisions in his way.

6. To Secure the Majority holders.

With the help of the written letters, the majority owner gets the most privileges. First, he holds the right not to contact mentally compelled to stay in business because the minority owner doesn’t want to sell it. Second, the majority owner can go against the will of the minority owner in case he finds an attractive offer to buy the company. There exists a clause named ‘Drag Along.’

In the case of a third-party buy-out, this clause directly instructs the minority owners to sell their shares. The minority owner is liable to do the two things in a case where the majority owner plans about selling his interests to a third party.

The minority owner can choose to be the transaction’s part by selling his goods to the same third party with the same offer, or he shall acquire the majority partner’s interests on the same grounds or bids.

7. To keep the investment of the partners safe.

A legal document comprises the provisions telling you what to do in the unseen scenarios. Also, It includes the owner’s disability, his death, bankruptcy, etc. Without the written agreement, the business dissolves in such cases.

It could lead to all the partner’s investments at a high level of risk. Such provisions bring forth the confidence, predictability, and answers to what immediate next steps are taken in unseen situations.

Such agreements also consist of the conditions. They are deep and say that none of the partners can leak or misuse its confidential information, especially competitors. The person committing this blunder is responsible for getting drag to court for justice.

Some Key Elements Covered in the Partnership Agreement:

1. Partners Legal Name

2. Nature of Partnership Business

3. Purpose of the Partnership

4. Partner information: Legal name as well as addresses

5. Contributions & Investment

6. Ownership interest

7. Profit/Loss distribution

8. Dispute Resolution

9. Amendment of Agreement

10. Applicable law

11. Partner Signatures

Who Needs a Partnership Agreement?

All the partners who have joined hands together as partners for a business require a written deal. This particular document will safeguard each partner’s investment and the newly established business itself. In case of any conflict, misunderstanding, or unclarity, this deal can be a helping hand to sort out everything. Partners of any companies need this as proof that they have contributed to this business and are eligible to gain all the benefits this business shall produce.

There are many unseen minor-level windfalls attach to this document. For example, during the arrival of chaotic times, the partners of any business only feel the most need of this legal paper to verify things are on track. Using this document, they can stop if things don’t go the way they are suppose to as the initial commitment. Moreover, it is a glimpse periodically to cross-check that all the parties are on the right track and aligned to a common business objective.

Why Should Every Partner Form Partnership Agreement?

Having a record of any partnership in writing at the very start of the business is quintessential. Understand the reason for it from the below section:

1. A written deal provides a pathway for avoiding any legal and liability matters. and Also, it frankly dictates the liability of each partner – general partners & the limited partners along with the liability of all partners as a whole.

2. They profoundly state the possibilities, situations, and terms for the new partners to enter the existing partnership.

3. The deal states the overall roles and responsibilities of every partner of the business. If any partner forgets his role in the partnership, he can revisit the document and check the same. Moreover, it lets you know how the decisions are going to be brought forward. Does it describe things like Who is going to take the lead as a managing partner? What responsibilities shall each partner possess? Ways to reverse the roles and responsibilities.

4. It provides the ease of resolving conflicts. A section stating how to resolve such disputes will be handy for both the parties involved in the agreement. For example, you can say things like – Can arbitration be considered? What individual commitments does each partner hold to resolve the conflict? Who reimburses for whatever happens?

5. The deal clearly states the ways to tackle scenarios concern with modifications in the existing partnership. and also this alteration can occur for several reasons like the death of a partner or a loved one, severe illness, traumatic situations like getting divorce, etc. Buy-out agreements handle such circumstances.

6. It is determining the ways to tackle the problems arising from the partner’s end. For example, it can be a dispute of interest or a non-compete agreement.

It helps in avoiding tax-related problems. It does so via declaring the general partnership’s tax status. and also, it claims that all the partners in the league are disseminating earned profits whose ground support is the satisfactory tax and accounting exercises.

7. It is essential for overriding the state-defined laws. Different states have different agreement languages that might not be the most suited one for your partnership. You need to accept state laws by default in case you don’t have a formal written agreement.